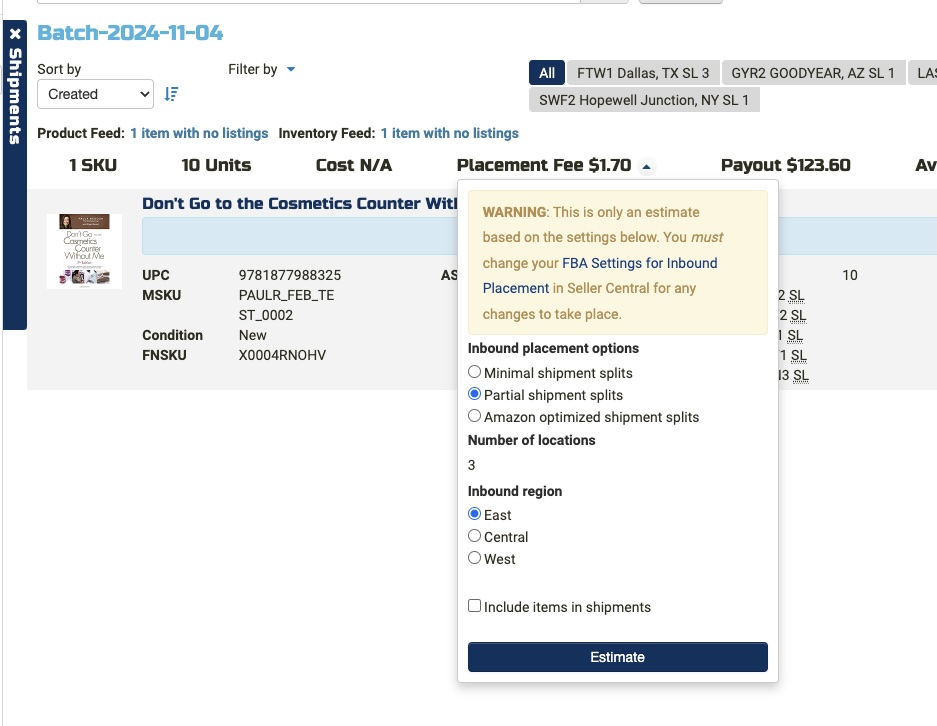

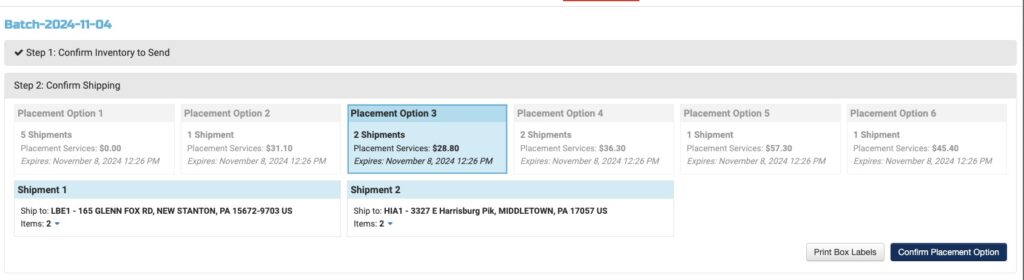

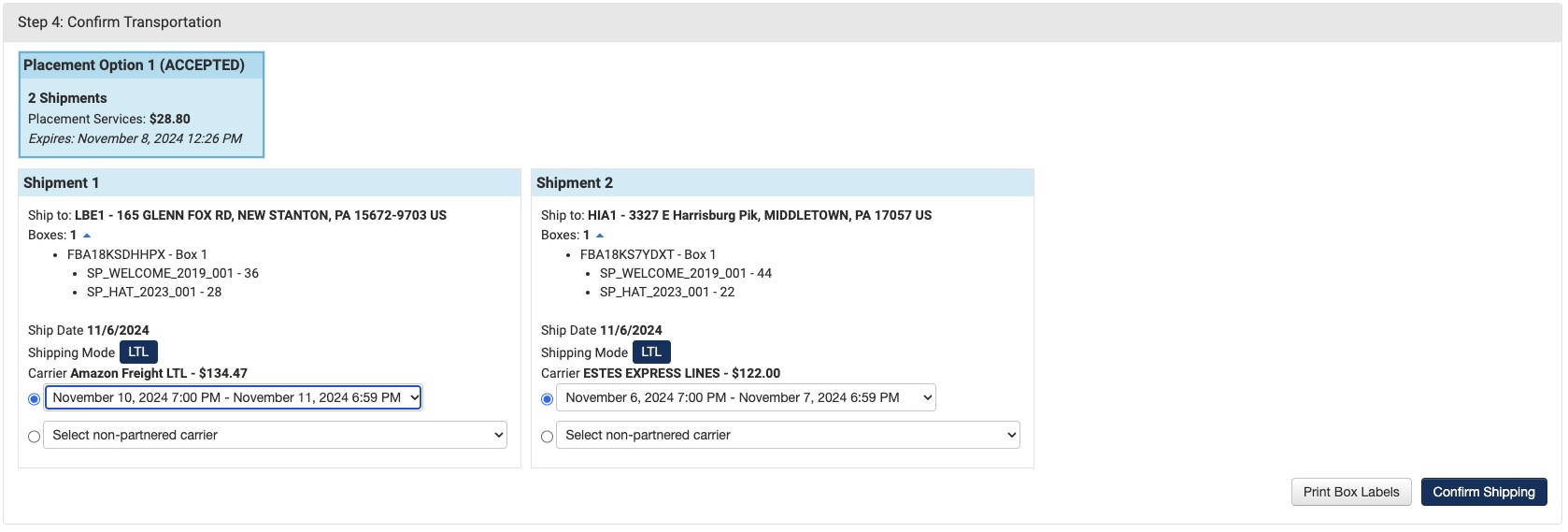

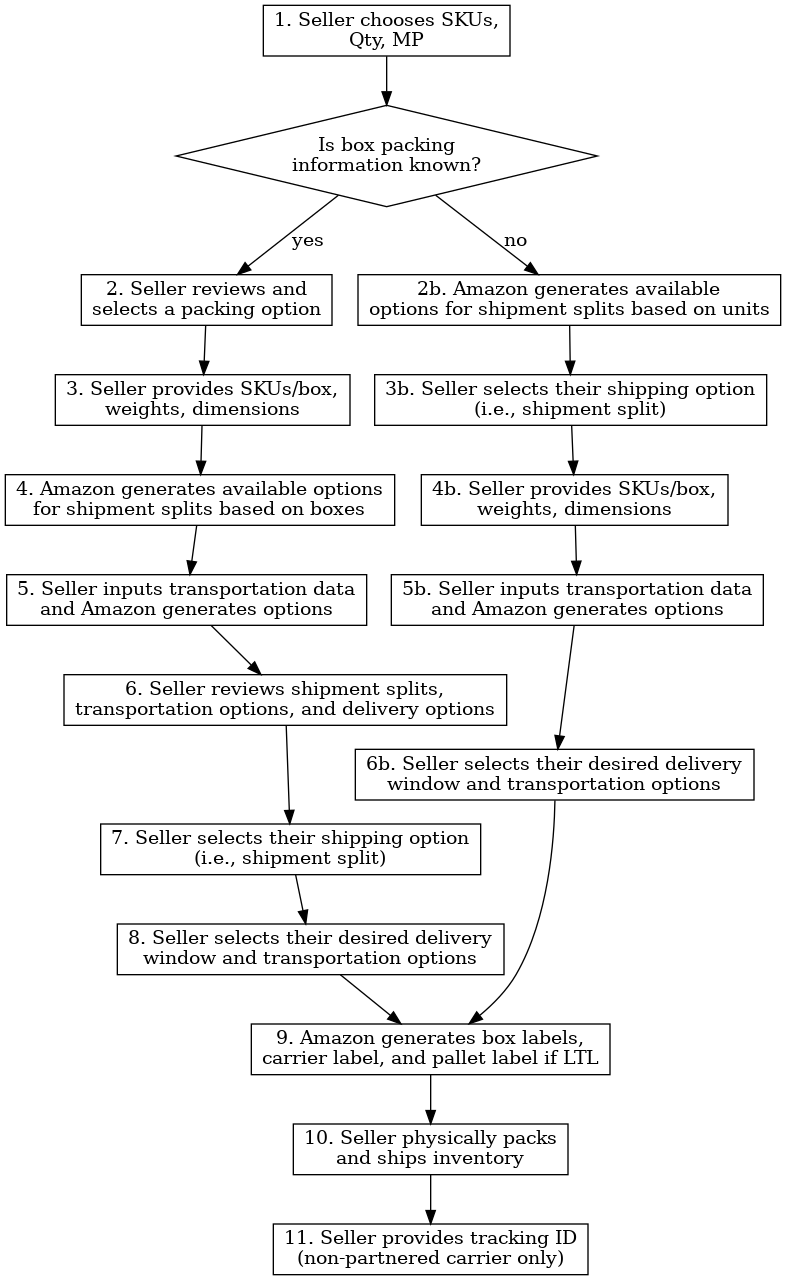

A little over a year ago we published the Readiness Guide for FBA as Amazon released the new Selling Partner (SP-API) FBA Inbound API. It helped many 3PLs, prep centers, and warehouses prepare for the harsh new reality of FBA that included placement fees and very little flexibility making adjustments to shipments. With the addition of separate packing flows, most prep centers had to choose between flexibility in packing and reduced costs for LTL/FTL shipments. Amazon Optimized shipments were poorly understood in terms of the tradeoffs between cost savings and shipment sizes.

As we close out 2025, the FBA Inbound flow is more reliable and the limitations are better understood. Error rates are lower than in previous quarters but annoying unrecoverable errors remain requiring cancelled shipping plans and re-labeling of boxes. We continue to work with Amazon’s FBA team to resolve these issues but the FBA team, like many at Amazon, were impacted by layoffs, return to work, and turnover.

What does FBA (and WFS) look like in 2026:

- Amazon prep and label service is discontinued – If you rely on Amazon to label or prep your items, it must now be done by your warehouse or prep center. Effective January 1, 2026.

- Register as an FBA Prep Provider on Amazon’s Service Provider Network if you want to

- Commingling for resellers will be discontinued in March 2026– You must FNSKU label your products before sending to FBA

- 2026 US Referral and FBA fee changes were announced –

- Walmart WFS is a viable fulfillment channel – Sellers are testing the waters with WFS as an alternate fulfillment channel to FBA. Some products work better than others, but the process is similar. If your prep center or warehouse is familiar with FBA they can pretty easily transition to WFS*.

- Walmart Multi-channel fulfillment is very competitive with Amazon and includes unbranded packaging at no extra cost

- *Look for a WFS readiness guide in early 2026 to help you prepare

With ongoing inflation and margin pressure on sellers, SPEED and ACCURACY are going to be critical for meeting customer expectations in addition to strict marketplace requirements.

ScanPower 2026

NEW features to improve Speed, Accuracy and Revenue Recognition:

- Walmart WFS support for both small parcel and LTL shipments

- Improved SKU View for packing FBA optimized shipments with 5+ splits

- Prep billing with support for prep tiers, standard item charges, per ASIN product charges, and ad-hoc charges

- NEW Warehouse Prep Billing app that integrates with ScanPower and Stripe to generate invoices for prep charges.